Homeowners Insurance in and around Cedar Rapids

Looking for homeowners insurance in Cedar Rapids?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Cedar Rapids

- Hiawatha

- Marion

- Palo

- Robins

- Center Point

- Urbana

- Shellsburg

- Atkins

- Eastern Iowa

- Tiffin

- North Liberty

- Iowa City

- Swisher

- Shueyville

- Anamosa

- Fairfax

- Walford

- Mount Vernon

- Linn County

With State Farm's Insurance, You Are Home

Being at home is great, but being at home with protection from State Farm is the cherry on top. This fantastic coverage is more than just precautionary in case of damage from ice storm or blizzard. It also can cover you in certain legal cases, such as someone slipping in your home and holding you responsible. If you have the right coverage, your insurance may cover these costs.

Looking for homeowners insurance in Cedar Rapids?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Why Homeowners In Cedar Rapids Choose State Farm

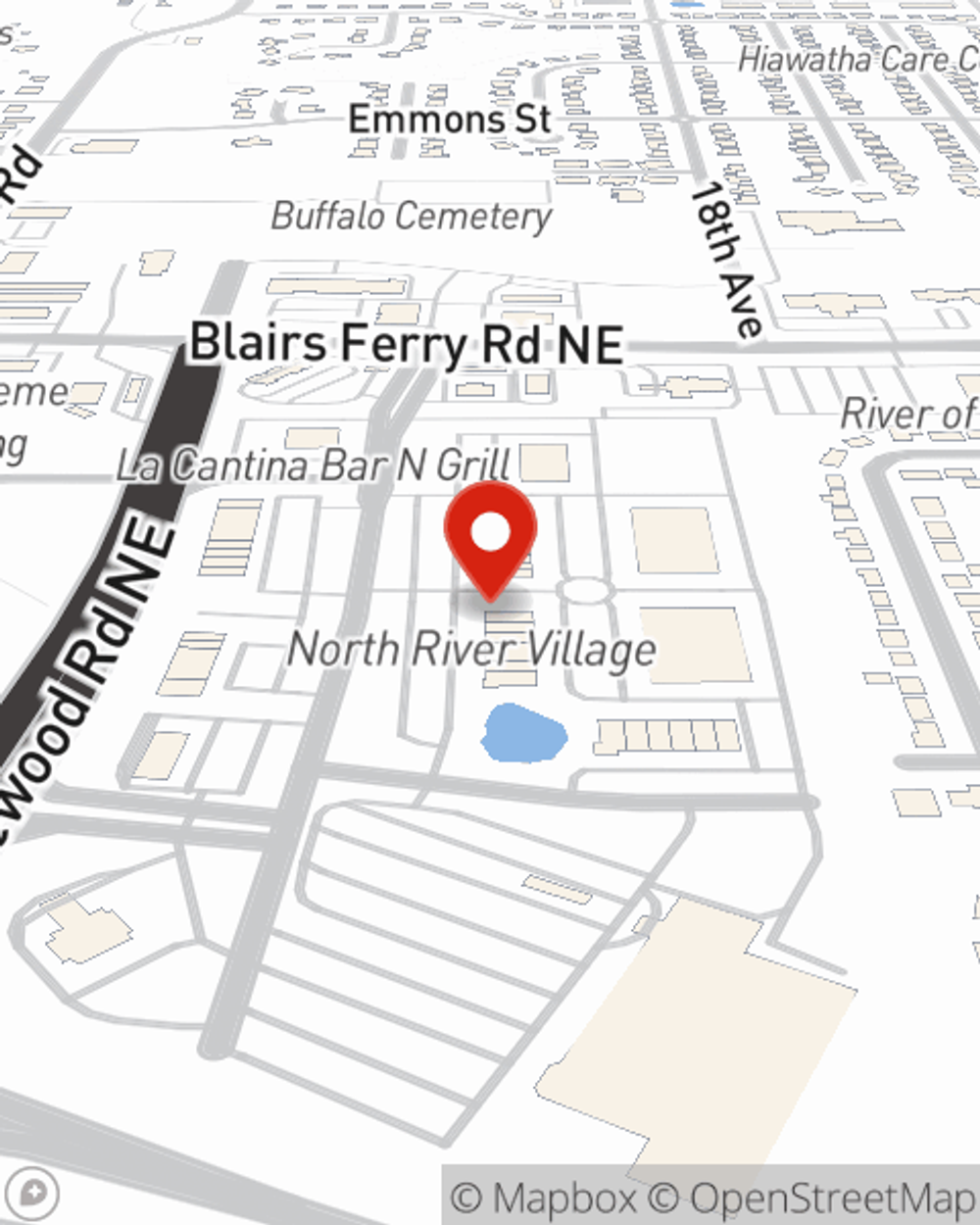

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Heath Kilpatrick can be there whenever trouble knocks on your door, to get your homelife back to normal. State Farm is there for you.

Let us help with the details of insuring your house with State Farm's outstanding homeowners insurance. All you need to do to get a quote is reach out to Heath Kilpatrick today!

Have More Questions About Homeowners Insurance?

Call Heath at (319) 743-3131 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Packing tips for moving

Packing tips for moving

Packing smart can help make moving furniture and packing up a house less frustrating. These packing tips can be a great way to get moving.

Protecting your home while on vacation

Protecting your home while on vacation

Home security while on vacation is important. Consider these tips before you head out.

Heath Kilpatrick

State Farm® Insurance AgentSimple Insights®

Packing tips for moving

Packing tips for moving

Packing smart can help make moving furniture and packing up a house less frustrating. These packing tips can be a great way to get moving.

Protecting your home while on vacation

Protecting your home while on vacation

Home security while on vacation is important. Consider these tips before you head out.